One thing I notice in each of the podcast episodes is that while our guests are focused on getting edges, and they talk about ideas like risk management, they’re still talking about gambling.

And I don’t mean gambling as a broad topic. I mean they are looking for ways to get exposure to variance.

The amount of risk they take on differs by guest, but they all have some amount of gamble in them.

For instance, video poker is a game where all of the probabilities are known. There are no “unknown unknowns” in video poker because it’s all based on a single deck, and a pay table. If you have that information you can calculate the return for any game. It’s the perfect game for a robotic approach to risk.

And yet…

This is a clip from Bob Dancer talking about a video poker promotion, where he had an edge, but he was also willing to take on more risk than he probably should have. He was outside the confines of appropriate bankroll management.

Bob Dancer - Nowhere Near Enough Bankroll

And if it seems like taking shots is limited to the casino, this is Blair Hull talking about stepping onto the CBOE floor on Black Monday 1987.

The market was dropping like a rock.

Blair says that he wanted some historical data to back up his intuition, but he couldn’t get that data. He was a buyer anyway.

Blair Hull - Black Monday

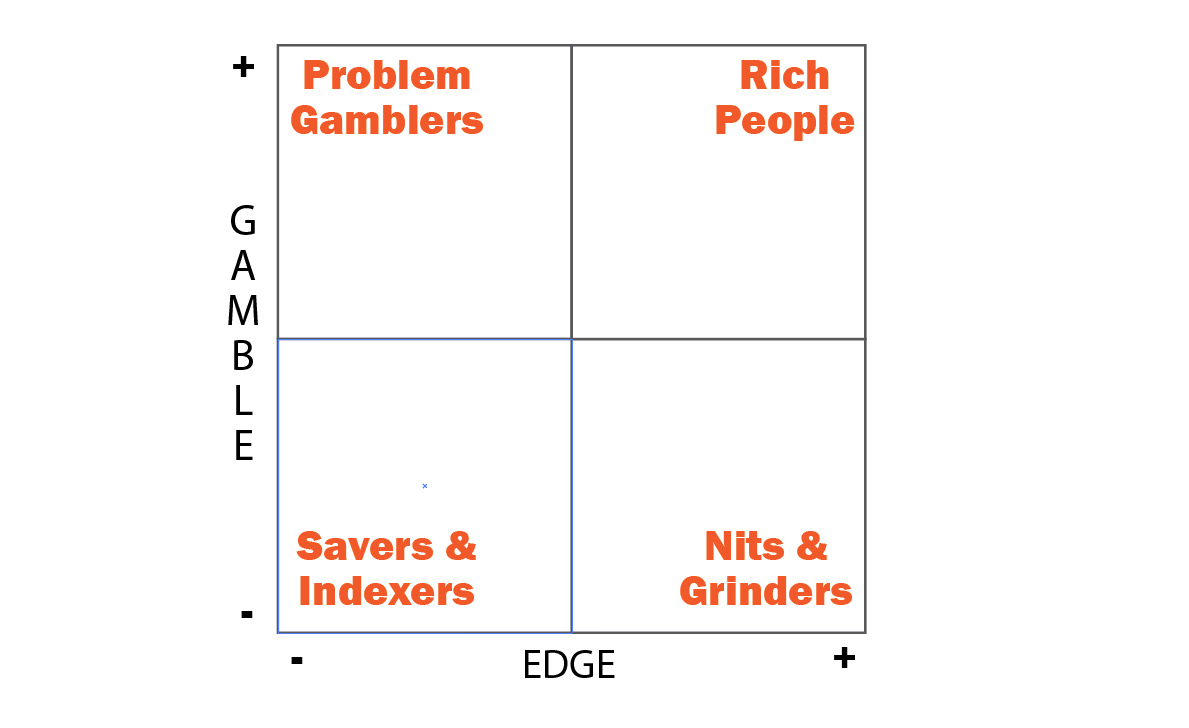

I was thinking about how our guests have some gamble in them and thought that maybe there’s something like a matrix of edge vs. gamble, and all risk takers land somewhere on the matrix. This is my attempt at the illustration.

So Savers/Indexers share an attitude toward risk with Nits/Grinders, and they share a lack of edge with Problem Gamblers. The upper right quadrant of the matrix is labeled Rich People - i.e. individuals that had edges and also the kind of attitude toward risk that would allow them to make a lot with those edges1.

After I made that illustration I could think of various guests and how they might exist on these two axes. For instance, the classic grinder that we’ve had on the show was Jim Pasko. He said that if it was a choice between taking on more risk, or putting in more hours, he was happy to put in more hours. Jim says that his attitude toward risk came from his childhood.

Jim Pasko - Grew Up Poor

Maybe the prototypical *gambler* that we've had on the show - the person who is more happy to load up on risk than any other guest - is the gas trader Bill Perkins. The title of his episode is “Bill Perkins is Not Afraid,” which is about his eagerness to eat variance with two spoons. Bill told me that he almost busted from extreme weather… twice!

Bill Perkins - Handling Variance

One litmus test to check someone’s attitude toward risk/variance would be to give them a free bet, and then see what they do with it. The legal sportsbooks have been doing exactly that over the past few years, and in response a cottage industry of bonus grinders has materialized. But much of the discussion around bonuses focuses on making variance-free money - which is not the highest EV use of the free bet. Richard Munchkin and Darryl Purpose made a lot of money on free bets in the 2000s, and they did it by accepting high variance. They saw that there were other people hammering the same promotions, but those people didn’t want any part of betting the longest (highest EV) odds.

Richard Munchkin - People Hate Risk

When you see that gamblers will vary in their attitudes as to how much variance they’re willing to accept relative to their edge, I suppose it makes sense that casinos and sportsbooks will also differ on that point. That sounds kind of stupid to say, since they are in the volume risk business. By the time they are deciding whether or not to accept a bet they have already spent money to acquire that customer. They should want as much as they are capitalized to handle.

But they’re also run by people.

Ray Marino has been both a sharp bettor and a bookmaker, so he’s seen all of the varying attitudes toward variance.

Ray Marino - Books Don’t Want to Take a Bet and Move the Number

The personal nature of attitude toward risk got a lot of attention recently because of the comments that Sam Bankman-Fried has made about Kelly betting. I think that discussion of SBF’s risk ideas is a little bit missing the point, since the most probable explanation for the FTX meltdown is something like:

FTX needed Alameda Research to act as a market maker to grow the FTX exchange’s liquidity.

Alameda was 40% of liquidity on the exchange in the early days.

Alameda needed FTX’s customer deposits from day one in order to actually trade. SBF actually admitted that early customers would wire money to Alameda and then get credited on the exchange, but there was no rigorous process to verify that Alameda ever sent the money to FTX.

Alameda didn’t actually have any edge and their claims about their trading prowess were b.s.2

No fraction of Kelly betting will save you if you don’t have an edge.

My point is that it makes sense to talk about risk attitudes for hedge funds that blow up, but we don’t need to talk about risk attitude if it was more of a Madoff situation. We don’t know for sure as it relates to SBF, but the evidence looks bad so far.

However, the whole thing did generate this very nice podcast from former LTCM partner Victor Haghani, who went into some of the underpinnings of the risk concepts that we use today, and which I highly recommend.

John Reeder

Risk of Ruin Podcast

One of the many great things about Rounders is that the entire movie is about Mike’s struggle to decide where he’s going to land on this matrix.

The strongest evidence for this claim is that Alameda passed around a graph of their trading results in the early days that literally looked like magic. Their results were uncorrelated to either price or volatility of BTC, and yet they were straight up and to the right. But then eventually Alameda said that they shifted their focus from algo trading to basically trading narratives like a recreational sportsbettor. So they went from having magic, to acting like any sucker in the sportsbook on Saturday? Doesn’t seem possible right?

Just want to say, I love all your content and your work. Thanks for all the guests, knowledge and summaries.